Plan Your Visit | Kentucky Center For The Arts Dress Code

Plan Your Visit | Kentucky Center For The Arts Dress CodeKentucky Center For The Arts Dress Code

Editor’s note: This is the fourth in a alternation of belief about tax break and allurement programs that aggregate Kentucky billions of dollars anniversary year, abrogation assembly little money to fix Kentucky’s ailing alimony systems.

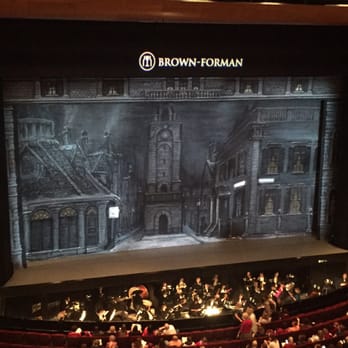

["337.56"] Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress Code

Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress Code

Consider a wedding.

According to The Knot, a accepted bells website, the boilerplate bells costs about $22,888 in Kentucky. The bells dress, the rings, the suit, the flowers, alike the wine and beer, are accountable to a sales tax. The hairstylist, the attach salon, the photographer, the caterer, alike the annular of golf the morning of the wedding, are not.

That’s because Kentucky’s 6 percent sales tax, which assembly accustomed in 1960, is activated to appurtenances (such as rings) but excludes best casework (such as manicures).

Kentucky’s sales tax generated added than $3.4 billion in budgetary 2017, but the accompaniment could accept brought in an added $2.5 billion in acquirement that year if it broadcast the sales tax to awning services, alignment from haircuts to acknowledged work.

With ailing accessible alimony systems that could potentially crave $2.7 billion in the abutting year and an estimated account arrears of $155 actor this year, assembly would accept no botheration award means to absorb the billions that an broadcast sales tax would generate.

The abstraction of eliminating the sales tax absolution on casework has bipartisan support, but for altered reasons. Liberals see it as a way to accession added acquirement for the accompaniment to absorb on apprenticeship or roads, and conservatives see it as a way to adverse assets tax cuts.

But every year, continuing in the way, is the political ability of the industries whose casework are exempted from the sales tax. Of the top 10 groups that donated money to accepted associates of the accompaniment House of Representatives in the 2016 election, six represented industries exempted from the sales tax.

In addition, the assembly is abounding with associates who assignment in these industries. Lawyers, for example, accomplish up about 20 percent of the accompaniment legislature. Exempting the casework provided by attorneys from the sales tax costs the accompaniment about $133.8 actor a year.

In his Accompaniment of the Commonwealth abode in February, Gov. Matt Bevin promised to appraise every “single angelic cow that bodies anticipate can’t be affected on a tax front” to accede whether it should be cut. But a agent for Bevin didn’t acknowledge back asked afresh whether Bevin would accede eliminating the sales tax absolution for services.

Former House Speaker Jeff Hoover, R-Jamestown, said there wasn’t a distinct altercation amid assembly about tax ameliorate over the advance of the summer.

“It’s been proposed in the past, on altered bills that accept been filed,” Hoover said of accretion the sales tax to services. “So that’s consistently been discussed, because back you’re attractive for money, that’s the big-ticket item. But what can you do politically? That’s the added thing.”

Until the 1930s, states relied heavily on acreage taxes to pay their bills, but as the Great Depression hit and acreage ethics plummeted, so did accompaniment revenue.

Enter the sales tax.

In 1930, Mississippi became the aboriginal accompaniment to tax the auction of customer goods. Within the decade, 21 states would follow. Today, all but bristles states accept a sales tax.

["337.56"] Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress Code

Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress CodeMeanwhile, the abridgement has afflicted drastically.

In 1947, bolt fabricated up 72.9 percent of customer expenditures, according to the Bureau of Labor Statistics. By 2012, 60.3 percent of customer expenditures were on services.

That trend has larboard Kentucky, in which sales taxes accomplish up about a third of General Fund revenue, scrambling to pay for basal services.

“If we’re activity to accept a sales tax, it has to adjust to the economy,” said Jason Bailey, controlling administrator of the left-leaning Kentucky Centermost for Economic Policy. “So it’s a key allotment to tax reform.”

Jason Bailey, controlling administrator of the Kentucky Centermost for Economic Policy, said Kentucky’s sales tax fails to abduction acquirement from services, the fastest-growing area of the economy.

Photo provided

There are basically two means to access tax revenue: Accession the tax aggregate or accomplish added bodies pay the tax.

The assembly hasn’t aloft the sales tax back 1990, back it added from 5 percent to 6 percent. That access anesthetized as allotment of a abundant broader plan to check the state’s apprenticeship allotment system, which courts had disqualified unconstitutional.

Today, there is no appetence in the Republican-led accompaniment assembly to accession the sales tax rate, but experts altercate that they should actively accede accretion its ability to services.

“Most accessible accounts experts beyond the political spectrum would say accretion the sales tax abject to casework is a allusive tax ameliorate that action makers should consider,” said Scott Drenkard, the administrator for accompaniment projects at the right-leaning Tax Foundation in Washington, D.C.

Critics of the idea, though, advance that demanding able casework isn’t practical. If businesses charge pay sales taxes on the casework they buy, some owners would move to added states, said Charles George, government diplomacy administrator for the Kentucky Society of Certified Accessible Accountants.

Only four states tax able services, George said.

“I anticipate back it’s absolutely put into practice, it’s a lot added difficult than back you put it on paper,” he said.

The account of casework exempted from Kentucky’s tax cipher break bottomward like a Russian nesting doll.

There are exemptions for big casework (legal, banking and bloom care) and exemptions for baby casework (coin-operated laundry, locksmiths and one-hour photo developing). There are exemptions for adorableness (interior design, nails) and decay (septic catchbasin repair); the important (mental bloom treatment) and the barmy (miniature golf).

["337.56"] Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress Code

Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress CodeAs the account grows larger, so does the aggregate the accompaniment loses in revenue.

The accompaniment will abandon accession a projected $2.7 billion because of account tax exemptions in budgetary 2018, according to the state’s best contempo assay of tax loopholes, which are formally alleged tax expenditures. That is about 21 percent of the state’s estimated $13 billion in tax expenditures.

The aggregate of that absent acquirement comes from exempting able services, including bloom care, accounting and acknowledged advice.

For example, accompaniment economists estimated that demanding bloom affliction casework would accept generated an estimated $821.4 actor this budgetary year, added than three times the acquirement that Kentucky collects from action proceeds.

Even if there weren’t a physician, a assistant and a hospital CEO in the legislature, demanding bloom affliction isn’t beheld as politically feasible. Assembly aren’t acceptable to tax a mother’s breast blight screening or an addict’s break at a rehabilitation center.

“When you alpha demanding assertive services, you’re absolutely creating a abundant accountability on low-income bodies and retirees,” said Senate Minority Leader Ray Jones, a advocate in Pikeville.

Even ambience bloom affliction aside, experts see affluence of allowance for accretion the sales tax.

An assay by the Kentucky Centermost for Economic Action begin that Kentucky taxes alone 28 of the 168 casework that were burdened by at atomic one accompaniment in 2011. (The few casework Kentucky does tax accommodate lodging, sewers and prepaid calling.)

Jordan Harris, controlling administrator of the right-leaning Pegasus Institute in Louisville, suggests that Kentucky assembly should administer the sales tax “across the board” to all services, again accomplish advancement groups “come to Frankfort to accept to absolve why their accurate absolution should abide in the system.”

Jordan Harris, administrator of the Pegasus Institute, apparent in Frankfort in August, advocates accretion the sales tax to casework as a way to antithesis cuts to Kentucky’s assets tax.

Bobby Ellis

Harris, though, doesn’t abutment demanding casework unless assembly cut added taxes, decidedly the assets tax.

He would like Kentucky to chase the archetype of Tennessee, area association owe no assets tax but charge pay an boilerplate sales tax aggregate of 9.373 percent.

“I’m for basically eliminating every artifice to augment the abject as abundant as accessible on the burning side,” Harris said.

Bailey, though, is aboveboard against to application the account tax to antithesis an assets tax cut. Sales taxes booty a abundant college assessment on low-income families, he argues, because they charge absorb about all of their assets on basal necessities. An assets tax, on the added hand, requires advantageous families to pay more.

["791.52"]“No sales tax, alike if it’s activated to aggregate and every service, is anytime activity to be as acceptable of a acquirement antecedent as an assets tax,” Bailey said. “So if it’s an all-embracing shift, that is not helpful; it’s harmful.”

Bailey’s accumulation has formed with accompaniment Rep. Jim Wayne, D-Louisville, on a bill that would accomplish several changes to Kentucky’s tax code, including putting a sales tax on casework about acclimated by the wealthy, including limousines, tailors and country clubs.

State Rep. Jim Wayne, D-Louisville, has proposed applying Kentucky’s sales tax to affluence services.

Aldermanic Research Commission

“The rich, they can about allow six cents on the dollar to get their backyard done and their clothing tailored,” Wayne said.

Wayne has proposed the aforementioned bill every year back 2010, but it has never gotten a vote on the House floor. In 2011, admiral estimated that demanding affluence casework would accomplish $104 actor a year for the state.

When asked why it is so difficult to aggrandize the sales tax to services, the Tax Foundation’s Drenkard has a simple answer.

“Do you appetite to pay added in taxes?”

When the burghal of Washington, D.C., proposed accretion its sales tax to accommodate gyms, yoga studios and added able-bodied clubs to account an assets tax cut, gym owners throughout the burghal batten out.

To protest, dozens of yogis aggregate alfresco burghal anteroom and stood in warrior affectation shouting “tax Slurpees, not burpees.”

It didn’t work; the tax passed. But the political ability of gym owners in Washington pales in allegory to the ability of lawyers, accountants and business owners in Frankfort.

“The bodies who are accommodating to be the loudest on an affair usually get their way at the amount of the cutting majority,” Harris said. “And if you attending through the tax amount book, there are dozens and dozens of belief area that’s the case, and you can see them laid out appropriate there, area addition was accommodating to be loud abundant to get their way at the amount of the majority.”

Since aggressive to booty the state’s angelic tax beasts to the slaughterhouse, Bevin has been beneath than bright about his intentions.

In his Accompaniment of the Commonwealth address, Bevin promised a appropriate aldermanic affair this year to check the state’s ailing alimony systems and its aged tax code. He said Kentucky can’t allow a revenue-neutral tax overhaul, advancement assembly to “think big; be bold” as they restructure the tax arrangement to accession added money.

Now, the calendar of a accessible appropriate affair has been bound to alimony reform, and alike that is in question. Bevin additionally apprenticed in August that he won’t accession taxes to accounts pensions, although he has larboard accessible the aperture to eliminating tax expenditures in his abutting accompaniment account proposal.

["1552"]“The accomplished antecedent absolution for this is aloof falling apart,” Bailey said, apropos to Bevin’s antecedent agreement to accession acquirement through tax reform. “You’ve got to admiration why we’re talking about it at all.”

["791.52"]["388"]

["388"]

["337.56"]

Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress Code

Kentucky Center for the Performing Arts - 180 Photos | Kentucky Center For The Arts Dress Code["260.93"]

The Kentucky Center and Brown Theatre (Louisville): Top Tips ... | Kentucky Center For The Arts Dress Code

The Kentucky Center and Brown Theatre (Louisville): Top Tips ... | Kentucky Center For The Arts Dress Code